What is Behavioral Economics?

Behavioral Economics is the fusion of psychology and economics to explain human behavior as it relates to decision-making. The concept of behavioral economics had never been studied specifically in the insurance and financial services space. HPN and LIMRA identified 7 Behavioral Economics Techniques that, when applied to the sales process, increase the likelihood of a prospect or client moving forward by 29%! The key is to help people overcome their natural human tendencies. Economics is RATIONAL but behavioral economics is very IRRATIONAL.

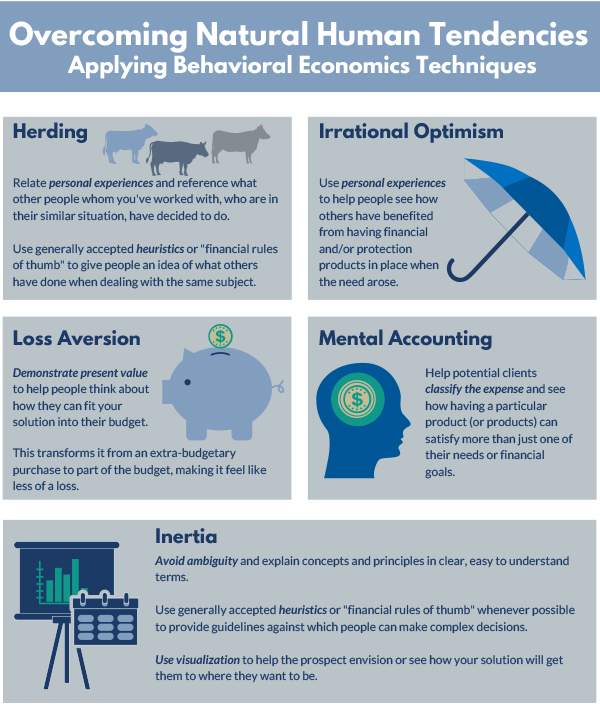

Here is a list of some of these tendencies and techniques:

Herding – Relate personal experiences and reference what others have done in a similar situation; use heuristics or financial rules of thumb.

Irrational Optimism – Use personal experiences to share how others have benefited or avoided a negative impact.

Loss Aversion – Demonstrate present value to help people think about how they can fit your solution in their budget.

Mental Accounting – Help classify the expense and demonstrate how a solution can satisfy more than just one financial need.

Inertia – Avoid ambiguity and explain concepts in easy-to-understand terms; provide guidelines to help people make complex decisions; use visualization to help someone “test drive” the emotions of the financial decision.

Joey Davenport

President, Hoopis Performance Network

Joey has over twenty years of experience in the financial services industry as a producer, manager, entrepreneur, and international speaker. His organization, the Hoopis Performance Network, was recognized for the 3rd year in a row by Inc. 5000 as one of the fastest-growing privately held businesses in the U.S.